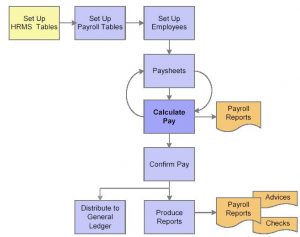

“An effective and efficient payroll management is, therefore, one of the most powerful weapons for enhancing staff morale and bolstering business”

Payroll management is an important component of any business. Making sure that your employees are paid accurately and on-time, filing taxes according to state and federal law and ensuring that you are in compliance with all agencies requires time and skillful execution.

A Great Payroll Management System Will:

- Accurately calculate employee earnings, withholdings for taxes and other deductions

- Provide detailed payroll reports, customized for your specific needs

- Report and deposit payroll taxes accurately and on time to the appropriate agency

- Make sure your company is aware of laws and regulatory chance so that you are in compliance with local, state and federal law

A grantor realizes that beneficiary of the trust is not able to deal with the treasuries independently. A simple example is that parents set up such trust for their child which deposit money for the financial security of the children until they reach a certain age limit. In the case of death of one or both parent, the children will have access to their funds secured in the trust account.

A grantor realizes that beneficiary of the trust is not able to deal with the treasuries independently. A simple example is that parents set up such trust for their child which deposit money for the financial security of the children until they reach a certain age limit. In the case of death of one or both parent, the children will have access to their funds secured in the trust account.

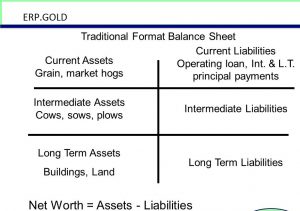

Financial reports are the periodic reports of information on financial statements of a company, including its financial position and performance, for the use of management or an external party. The four primary financial reports in business are the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity.

Financial reports are the periodic reports of information on financial statements of a company, including its financial position and performance, for the use of management or an external party. The four primary financial reports in business are the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity.