To make certain decisions in business for investing and managing resources we need to have proper details of each and every part of business incoming and outgoing funds. All this information must be analyzed on the monthly, quarterly or yearly basis.

Three basics reports are generated for this purpose Cash Flow, Income Statement, and Balance Sheet to understand and demonstrate business operations in a documented manner.

Let’s take a look at the purpose of each document.

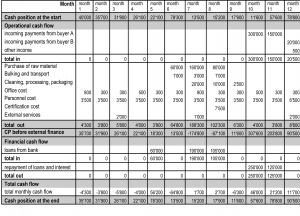

Cash Flow Statements:

Cash flow statement measures the amount of cash that flows into the company and out of it over a certain time period. This helps the company to keep track of the money is has and to pay the expenses on time.

Cash flow statement estimates the net increment and decrement in cash for given period. It is mostly divided into three separate activities: investing, financing and operating activity. Having a full knowledge of financial status let you maintain your financial health more wisely.

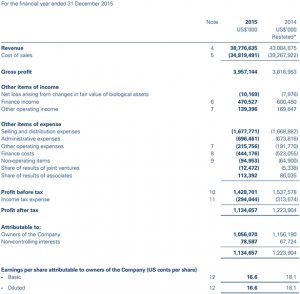

Income Statement:

It’s an important document for the investor to support in decision making. It records the information in journals and ledgers and converts them into compiled and concise expenses and revenue figures. It displays the company revenues and expenses for a certain period of time which allows investors to have a look at the financial status of the company and valuable information on company’s income, gross profit and sales.

This information lets investors calculate the necessary figures to estimate that they are investing in the right place. For example, income statement of two consecutive years helps to determine the transition in trend and sales in terms of improvement and growth.

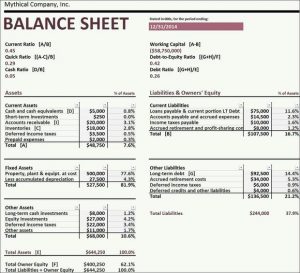

Balance Sheet:

The balance sheet shows the company’s assets, liabilities, and equity. Assets are what a business uses to operate its business, while its liabilities and equity are two sources that support these assets. The difference between assets and liabilities demonstrate the net worth of the business to show the measurement of financial power. It also provides information that how much capable a business is to pay its debts.

A balance sheet helps in decision making regarding the equipment to purchase for business. Balance sheet analyses the right move to make for paying debts. The balance sheet is also used by government agencies to ensure that business is in compliance with the current laws. It provides information to potential lenders to show the creditworthiness of the business.

Importance of the three

To understand the financial situation of a business all these three statements are necessary separately. If you consider only one statement you are left with limited information other two will provide. To make wise and long term financial decisions in the different situation there is need of a proper view of each and every financial part of the business.

These three major statements let investors and business managers know every aspect of the company. Only one stamen is not enough to state all the information necessary for the successful continuity of the business.