Capital is the money businesses use for financing their operations. It’s the financing for the small business or the money used to operate and purchase of assets. Cost of capital is the cost of obtaining that money or financing for the small business. The cost of capital is also called the hurdle rate. Cost of capital is the key to all business decisions.

Cost of Capital

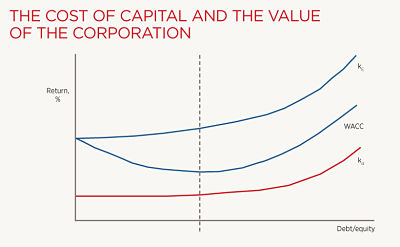

The combination of debt and equity financing for a company is the company’s capital structure.

Should small businesses even worry about their cost of capital? The answer to that is absolutely yes! Because small businesses need money to operate and that money is going to cost something. Even companies want that cost to be as low as possible.

Capital for a small business is simply money. For larger businesses, capital may be the supplier credit and longer term debt or liabilities, which are the firm’s liabilities.

If a company is public or takes on investors, then capital will also include equity capital or common stock. Other equity accounts will be retained earnings, paid-in capital, perhaps preferred stock.

What is Return on Capital?

Return on capital is the amount of profit you earn out of a business or project as compared to the amount of capital you invested. The key to COC for a company is that a company’s return on capital must always equal or exceed the cost of capital for any project in which the firm wants to invest.

What Composes the Cost of Capital?

- One component of the cost of capital is the cost of debt financing. For larger businesses, debt usually means large loans or bonds. For small companies, the debt can mean trade credit. For either, the cost of debt is the interest rate the company pays on the debt.

- Another component of the cost of capital is the cost of equity financing if your company is a public company; in other words, if you have investors in your company who provide money in exchange for an ownership stake in the company.

There are several components of the cost of equity capital:

- First, there is the cost of retained earnings or the money that the company invests back into the company, instead of paying out dividends.

- Next, there is the cost of new common stock or stock that the company issues to raise money. Last, the company may even issue preferred stock to raise money.

The Company’s Weighted Average Cost of Capital:

Once the business owners understand the concepts of capital and cost of capital, the next step is to understand weighted average COC. Each capital component is a certain percentage of the company’s capital structure.

In order to arrive at the true cost of capital for a business firm, the owner must multiply the percentage of the company’s capital structure for each component by the cost of that component and sum them.

Read More:-Capital Budgeting: Worth in Business