A financial Statement is a summary report of the financial activities and the position of a certain business, person, or other entity. The basic financial statements are aBalance Sheet, Income Statement, and Statement of changes in equity.

How to prepare financial Statements

Preparing general-purpose financial statements can be simple or complex depending on the size of the company. Some statements need footnote disclosures while others can be presented without any. Details like this generally depend on the purpose of the financial statements.

Financial statements are prepared by transferring the account balances on the adjusted trial balance to a set of financial statement templates. For example Paul’s Guitar Shop, Inc.’s financial statements based on his adjusted trial balance. Paul can use these statements internally to gauge the performance of his store for the year or he can issue them to lenders or investors to help raise funds to expand the store.

Once the Financial statements have been prepared, Paul can add the financial statements to the accounting worksheet and close his books for the year by recording closing entries in the next accounting cycle step.

How to Prepare Income Statement

An income statement is very important part of financial statements, it contains information about a company’s revenues and expenses and the resulting net income.Net income is computed by deducting all expenses from all revenues. It is the primary measure of the company’s ability to make money.

How to Prepare the Balance Sheet

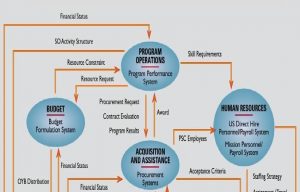

Image source: http://www.apapracticecentral.org/

The “Balance Sheet”, also known as “Statement of Financial Position”, shows a company’s financial condition as of a certain date.Financial condition is presented by reporting how much in assets the company owns, how much liability it owes to others, and its equity or capital (assets minus liabilities).

How to Prepare Owner Equity

The “Statement of Owner’s Equity”, summarizes the items affecting the capital account of a sole proprietorship business.A sole proprietorship’s capital is affected by four items: owner’s contributions, owner’s withdrawals, income, and expenses.

Decision making is one function of management which can only be achieved if managers are equipped with the right format information of financial statements at the right time.

The ERP Gold Accounting solution comes with decision support features which allow business process owners to generate useful financial statements that can aid quality decision making.

Get a 45 day trial visit:http://us.erp.gold/register